Census Overview & Challenges

Why is the Census important for Texans?

Data from the Census informs the distribution of billions of dollars of federal funding and state representation in the U.S. House of Representatives. How does this affect Texas?

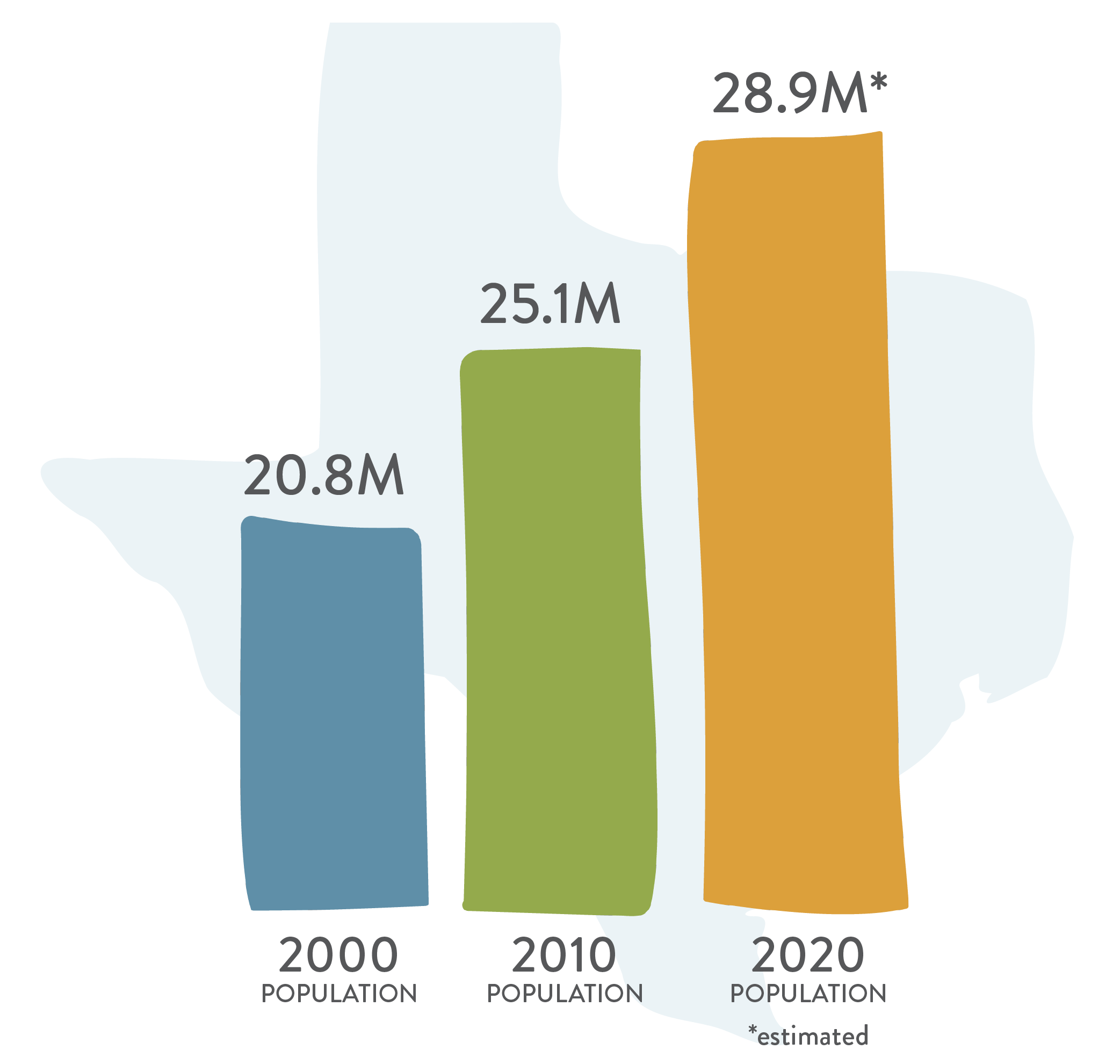

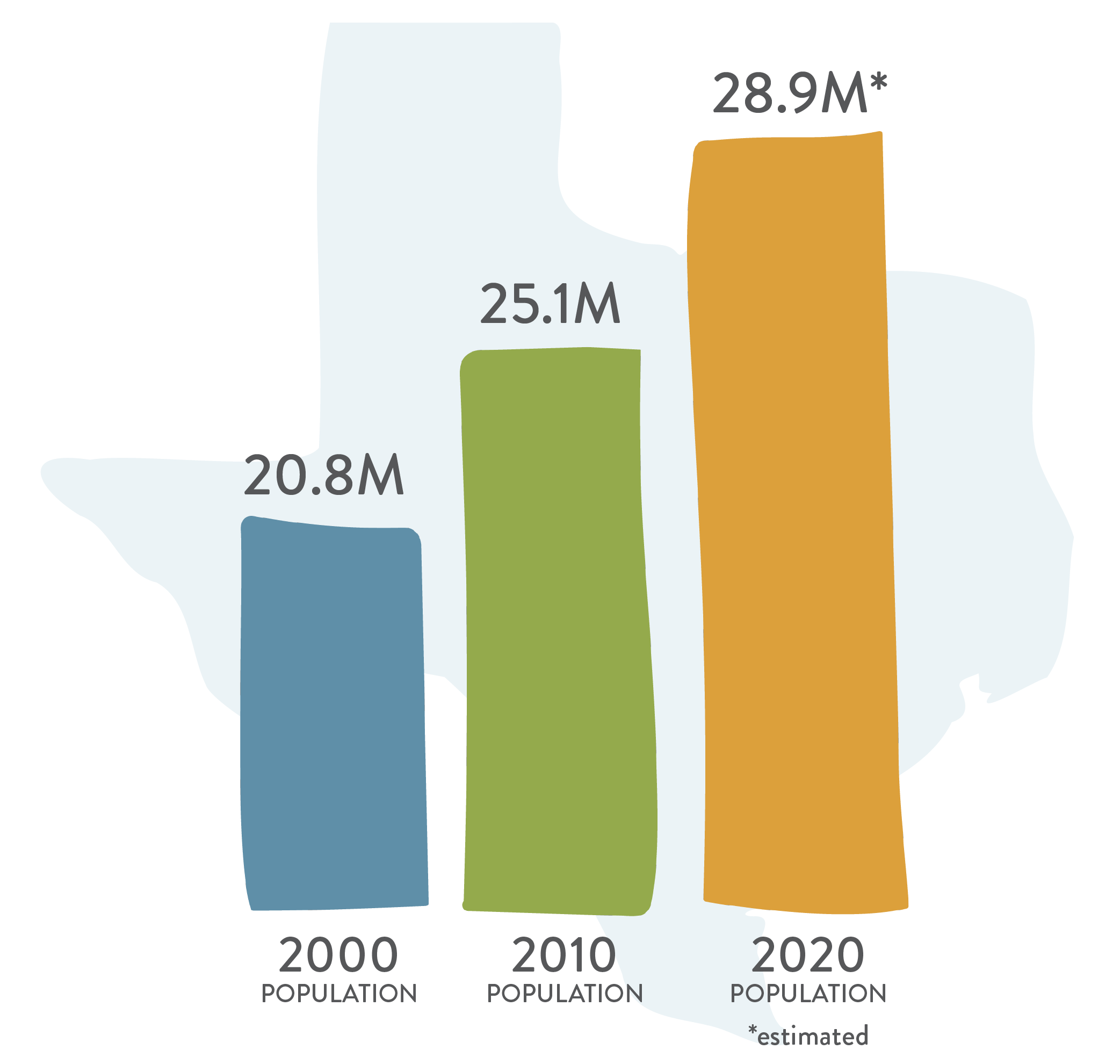

The population of Texas has grown tremendously since the 2010 Census, and as a result, the state is eligible for more federal funding that supports critical services such as hospitals, schools, emergency services, infrastructure improvements, and more.

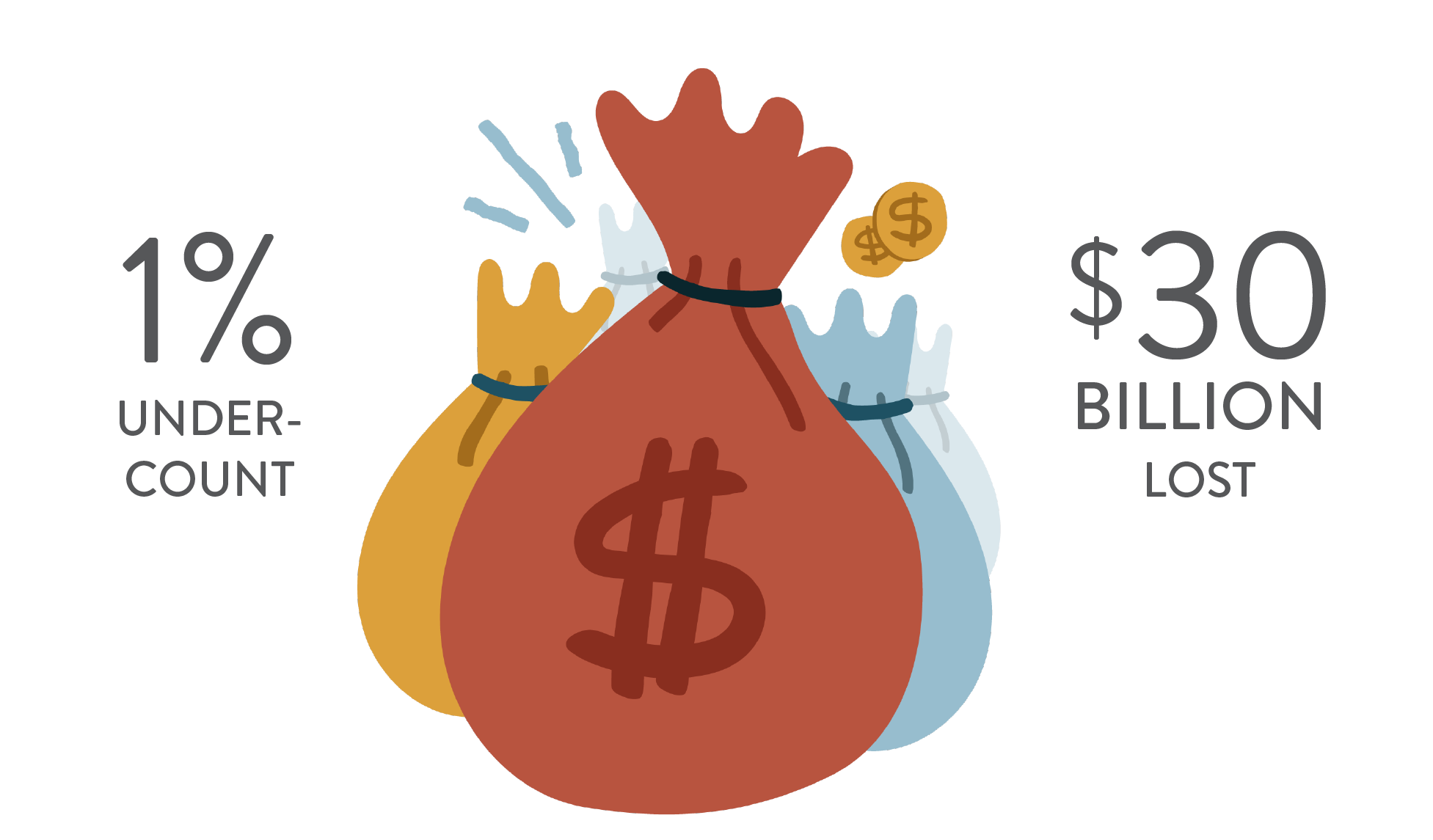

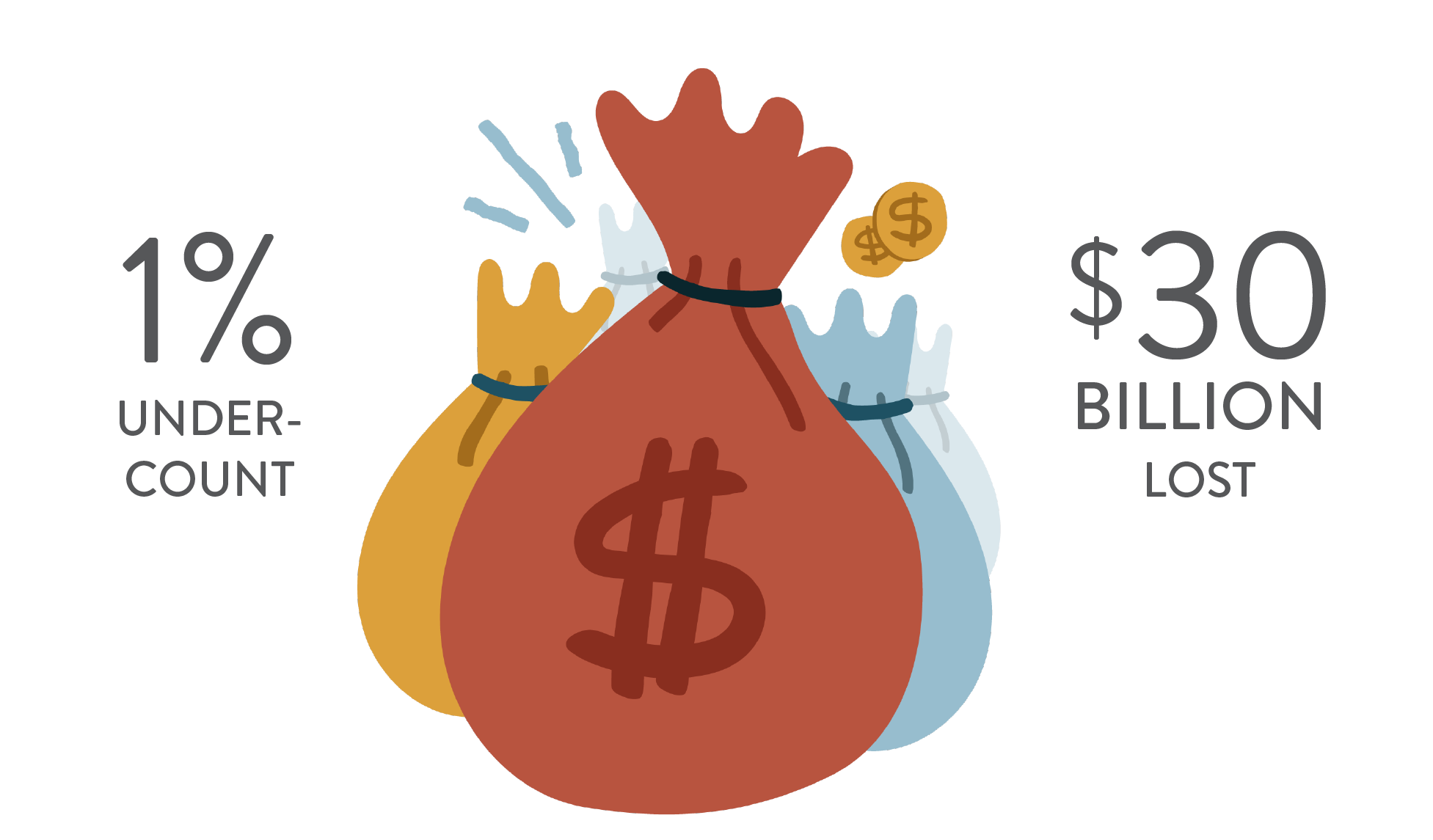

An undercount in the 2020 Census could account for billions of lost funding over the next decade…

An undercount in the 2020 Census could account for billions of lost funding over the next decade…

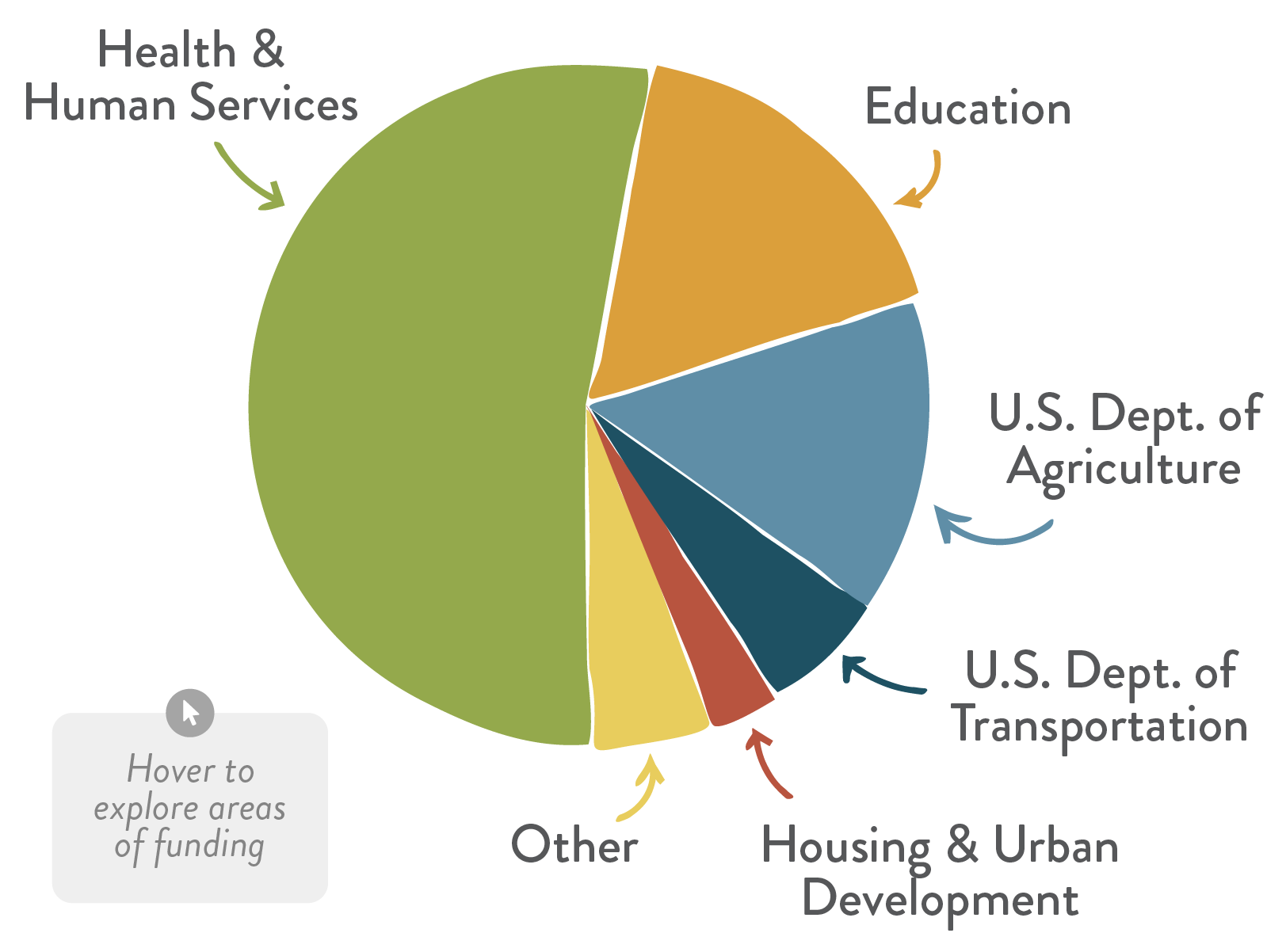

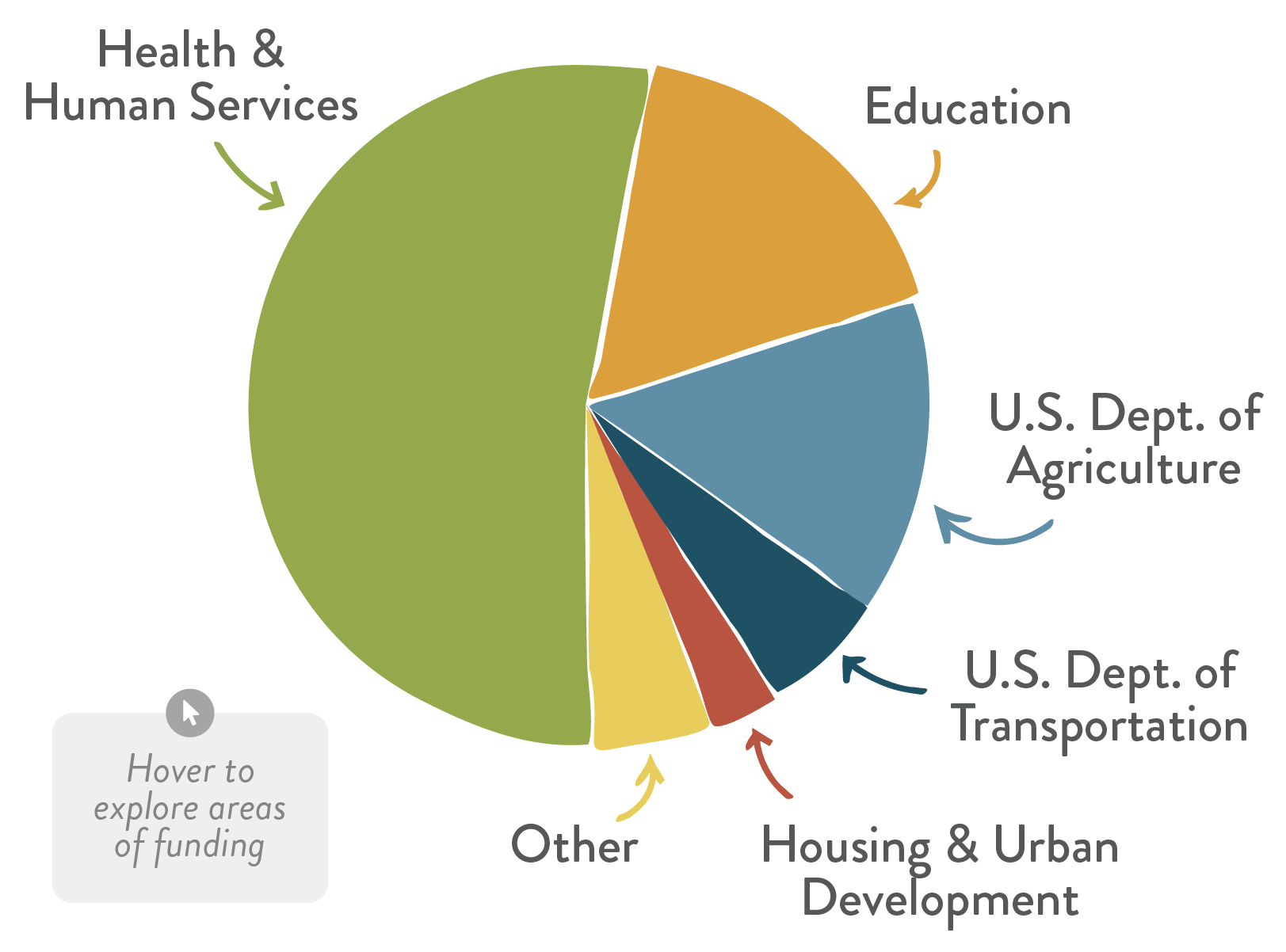

And reduce funding for federal programs that Texans rely on the most.

Health & Human Services (53%)

- Medicaid

- Medicare

- Adoption Assistance

- Prevention and Treatment of Substance Abuse

- Child Care and Development

- Community Services and Social Services Block Grants

- Head Start

- Health Care Centers

- Low Income Home Energy Assistance

- Special Programs for the Aging

- Children’s Health Insurance Program (CHIP)

- Foster Care

- Temporary Assistance for Needy Families

Education (17%)

- Federal Direct Student Loans

- Pell Grant Program

- Career and Technical Education

- Special Education Grants

- Effective Institution Grants

- Title I Grants

- Vocational Rehabilitation Grants

U.S. Department of Agriculture (15%)

- Supplemental Nutrition Assistance Program (SNAP)

- National School Lunch and Breakfast Programs

- Business and Industry Loans

- Child and Adult Care Food Program

- Community Facilities

- Cooperative Extension Service

- Rural Electrification

- Rural Rental Assistance Payments

- Water and Waste Disposal Systems for Rural Communities

- Low to Moderate Income Housing Loans

U.S. Department of Transportation (6%)

- Highway Planning and Construction

- Capital Investment Grants

- Federal Transit Formula Grants

Housing & Urban Development (3%)

- Section 8 Housing Vouchers and Payment Assistance Programs

- Community Development Block Grants

- Public and Indian Housing Funds

- Housing Assistance Payments Program

Other (6%)

- Low Income Housing and New Market Tax Credits

- Crime Victim Assistance

- Unemployment Insurance

- Employment Service Program

- Native American Employment & Training

- Historically Underrepresented Business (HUB) Programs

- Federal Procurement Programs

- Federal Tax Expenditures

- Workforce Innovation and Opportunity Act

- Homeland Security Grant Program

Texas was projected to gain 3 to 4 seats in the U.S. House of Representatives. However, the state only gained 2 based on 2020 Census population data.

A complete and accurate Census count ensures crucial funding and representation, to support our thriving Texas economy.

Health & Human Services (53%)

- Medicaid

- Medicare

- Adoption Assistance

- Prevention and Treatment of Substance Abuse

- Child Care and Development

- Community Services and Social Services Block Grants

- Head Start

- Health Care Centers

- Low Income Home Energy Assistance

- Special Programs for the Aging

- Children’s Health Insurance Program (CHIP)

- Foster Care

- Temporary Assistance for Needy Families

Education (17%)

- Federal Direct Student Loans

- Pell Grant Program

- Career and Technical Education

- Special Education Grants

- Effective Institution Grants

- Title I Grants

- Vocational Rehabilitation Grants

U.S. Department of Agriculture (15%)

- Supplemental Nutrition Assistance Program (SNAP)

- National School Lunch and Breakfast Programs

- Business and Industry Loans

- Child and Adult Care Food Program

- Community Facilities

- Cooperative Extension Service

- Rural Electrification

- Rural Rental Assistance Payments

- Water and Waste Disposal Systems for Rural Communities

- Low to Moderate Income Housing Loans

U.S. Department of Transportation (6%)

- Highway Planning and Construction

- Capital Investment Grants

- Federal Transit Formula Grants

Housing & Urban Development (3%)

- Section 8 Housing Vouchers and Payment Assistance Programs

- Community Development Block Grants

- Public and Indian Housing Funds

- Housing Assistance Payments Program

Other (6%)

- Low Income Housing and New Market Tax Credits

- Crime Victim Assistance

- Unemployment Insurance

- Employment Service Program

- Native American Employment & Training

- Historically Underrepresented Business (HUB) Programs

- Federal Procurement Programs

- Federal Tax Expenditures

- Workforce Innovation and Opportunity Act

- Homeland Security Grant Program

And reduce funding for federal programs that Texans rely on the most.

Texas was projected to gain 3 to 4 seats in the U.S. House of Representatives. However, the state only gained 2 based on 2020 Census population data.